How much money can a search fund entrepreneur make?

As a newly minted searcher, I had my eye on the prize. Before business school I had decided I wanted to do “something bigger” and “something entrepreneurial,” but I hadn’t decided much beyond that.

When I encountered the search fund model, I went through the typical cycle of emotions experienced by a prospective searcher - confusion, disbelief, denial, intrigue, curiosity, acceptance, excitement, commitment, evangelism. The idea of buying and running a company of my own was certainly exciting. It offered a promise of flexibility, control, thrill, and, if all went well, a good deal of cash at the end of the journey. I saw the dollar signs.

Around the same time I was exploring several startup ideas (I think I had a running list of about 130), but none of them would help me with my student loan payments in the first couple of years post-MBA. A search fund, by contrast, would enable me to take a salary from the day I closed the initial raise.

We’ve all heard the success stores (e.g. Asurion) that seriously enrich the entrepreneurs and their investors alike, but what is the likelihood of achieving such an outcome? Let’s temper the fables with some facts.

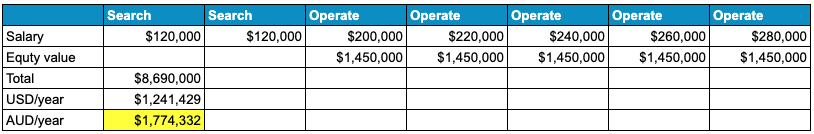

According to the 2022 Stanford Search Fund Study, searchers take a median salary of US$120k/year during the search period, which is a reduction of somewhere between 25% and 50% of a top-tier MBA’s expected post-graduation compensation.

Post-acquisition, median searcher-CEO compensation (base + bonus) grow over time since acquisition, from US$200k at under one year post-acquisition to US$270k for those 4-5 years post-acquisition.. Still less than what a top-tier MBA hopes to earn at Bain or Goldman, but not so bad.

The most exciting part of a searcher’s potential earnings is the carried interest (“carry”), the share of the profits generated by the deal that a searcher can earn over time. The 2022 study tells us more about this than historically, including the following highlights:

Search funds have now generated about US$2.4 billion of value for entrepreneurs.

The average search fund entrepreneur currently operating a business has earned US$6.38 million of equity, or US$2 million per year of operation.

The average exited search fund entrepreneur has earned US$7.57 million of equity, or US$1.45 million per year of operation.

With the above in mind, here is a hypothetical timeline of value creation for a search fund entrepreneur:

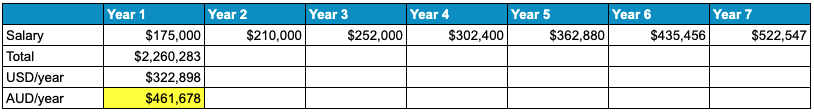

Assuming an initial compensation package worth US$175k and a 20% annual increase, here’s what that hypothetical would-be-searcher would earn in corporate job:

Search fund entrepreneurs who acquire and exit therefore stands to earn far more than their peers with corporate jobs.

This financial upside clearly matters to prospective searchers, but it also matters to investors! Investors care that searchers stands to earn significantly more than they would in a corporate job if the deal goes according to plan. More is better… to a point. When a searcher recently told an investor that she hoped to earn “a couple million” when all is said and done, the investor wasn’t impressed.

In general, investors want to see that a searcher stands to earn at least about US$5 million in equity value over the course of the investment. This ensures that the searcher is properly incentivized to perform, rather than being distracted by other exciting opportunities that will inevitably cross the desk of any operator worth her salt. (The searcher has to keep her nose to the grindstone when aspiring unicorns start fluttering options packages in their faces.)

Is the initial cut in compensation worth the long-term benefit? How about if I told you that if you launch a search, there’s a ⅓ chance you won’t buy anything at all and will wind up back at year 1 of the corporate ladder?

To keep ourselves honest, I’ll call out two things:

The above figures are medians. Financial outcomes for any individual searcher-CEO can be much greater or much less than these medians. Remember that 27% of acquisitions result in a negative return, which usually means an equity value of nil for the searcher.

The 34% of searchers who fail to acquire are not factored into the above scenarios.

But hey, Goldman can fire you too.