The 5 serial killers of search fund deals

Nearly every deal I’ve worked on has died. Several times.

Even those that end up closing have typically died a few times on the way to successful completion.

To seasoned searchers, this will come as no surprise; deals die all the time, and those that succeed rarely do so without an existential crisis or two. But to the prospective searcher, it can seem strange that, if the buyer and seller agree on a price, the transaction would not simply happen straight away.

In reality, deal killers come in many shapes and sizes, and most deals see several potential killers on the path to closing. Here are a few broad categories of deal killers to watch out for:

Skeletons

If you’re looking for the perfect company, stop. It doesn’t exist. Every company has issues, and it’s your job to decide which of these issues can be managed and which are deal killers.

Sometimes these issues are true skeletons in the closet - faults, liabilities, or misdeeds that the seller is aware of and hasn’t disclosed. Through proper diligence, these can often be uncovered. The stronger the relationship between the searcher and the sellers, employees, customers, and other stakeholders, the more likely everyone is to be transparent and collaborate openly.

The more common “skeletons,” and perhaps the more deadly, are those of which even the sellers are unaware. There could be something nasty festering in the books, the staff, the customer base, or elsewhere that the sellers just don’t know about. And because they aren’t aware of the problem, they can’t disclose it to you, the searcher.

When these surprise skeletons pop out of the closet, often through proper diligence, they can have a disastrous effect on the deal. The seller may accuse the searcher of fabricating the skeleton in an attempt to renegotiate. Or the seller may just be embarrassed and not want to own up to a mistake in front of not only the buyer, but the team, so they opt to sweep it under the rug and kill the deal.

2. Working capital

Despite its importance in M&A, most sellers in search fund deals don’t understand working capital. If they’ve heard the term before, they often equate it with cash. And when you ask the seller to leave some working capital in the business, she might be offended. “I made that money before you came along, searcher,” she thinks. “You can take the business, but that cash is mine.”

And then when you tell her that working capital is more than just cash, both the confusion and the offense taken can increase. She may accuse you of using your slimy MBA lingo to weasel more money out of her.

Clearly this isn’t the case. As you know or will soon know, working capital is an essential part of an operating business. Without it, the business can fall over. If what you’re buying is a going concern, then working capital is a vital component of that going concern.

But that explanation may sound like a bunch of hoopla to your seller, and you’ll have to find a way to get her on the same page without coming across as pedantic or stirring up emotions.

Even after she buys into the need for a working capital target, you’re still not out of the woods. The devil is in the details of the formula you use to calculate that target, and the more complex the business, the more murky the waters get.

And even after you agree on a working capital target and formula, it still may be subject to manipulation, which can throw a final wrench in the negotiations.

3. Emotions

Entire volumes could be written on the psychology of small business acquisitions, but I’ll try to capture the essence of this topic in this teeny weeny blog post.

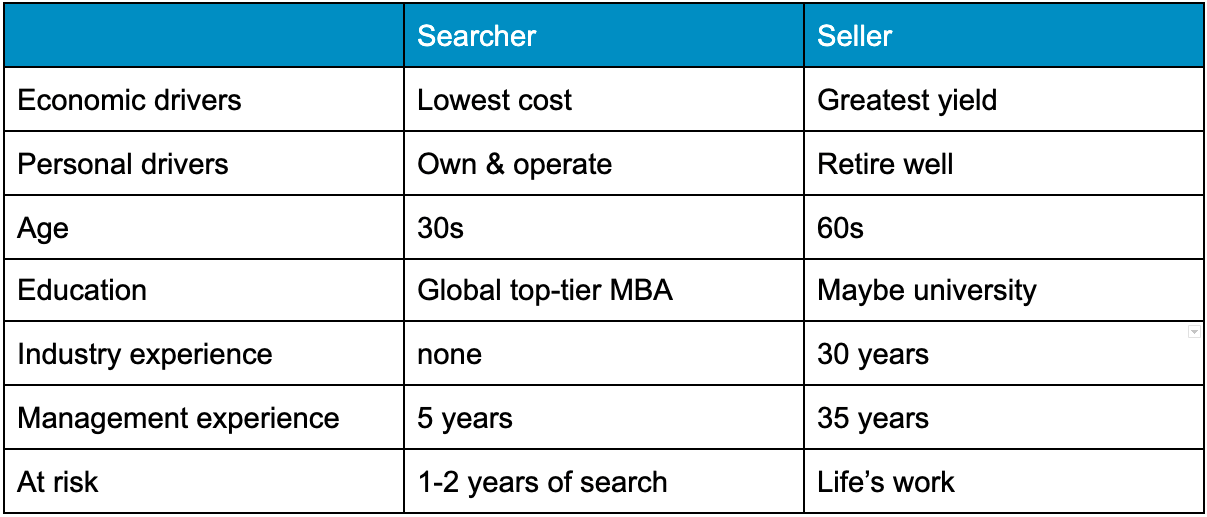

The crux of the issue is that the searcher and the seller are often coming into the deal from very different places. To summarize a typical search fund deal:

With a setup like this, empathy can be hard to come by in either direction. While very strong relationships can be and are routinely built between searcher and seller, this does not happen without turbulence. How the searcher manages that turbulence will heavily influence both whether the deal gets to closing and what happens thereafter.

4. Time

As they say, time kills all deals, an adage that rings true for at least two reasons.

The first is highly correlated to item #3 in this list - emotions. Time-to-closing is often directly correlated with frustration, mistrust, and doubt, and is inversely correlated with empathy, excitement, and optimism. There’s only so long either party can hold on to that dream of what comes after closing before getting lost in the day-to-day challenges of getting the deal done.

Time is also the enemy because with time come options for both the seller and the searcher. The seller may come across other buyers or alternative exit opportunities, reducing the perceived value of the offer on the table, and the searcher may be tempted by a deal in the pipeline that distracts her from the deal at hand. Each of these scenarios can reduce the mutual commitment to the deal necessary to push it to closing.

5. Third parties

While the searcher-seller interactions have the greatest impact on the success of the deal, the many third parties involved also have the power to derail it.

Attorneys, accountants, investors, lenders, consultants, and loved ones all have the power to influence the trajectory of a deal. Of course they do! That’s why we bring them into the deal in the first place - we want their input.

If third-party input kills a deal that really should die, that’s a good thing. However, the following can be ingredients for a good deal gone pear-shaped:

Bad advice - Sometimes our advisors are wrong. They miscalculate, overstep, or misinterpret, resulting in advice that doesn’t meet the needs of the deal.

Bad judgement - If either the seller or the searcher fails to appropriately put the advice they receive through the filter of their own judgement, if they blindly follow every bit of advice from people with little-to-no skin in the deal, they can make unnecessary mistakes that prove fatal to an otherwise good deal.

--

From my anecdotal observation, a searcher typically signs a few LOIs before closing on something, meaning two out of three serious deals die, thereby viciously sucking the lifeblood of the search - time.

So no, dear searcher, you’re probably not going to buy a company in six months.

6. Funding

Shout-out to Olivier Stapylton-Smith for adding this one to the list. Absolutely, the presence or absence of reliable and sophisticated sources for both debt and equity capital will affect the deal’s mortality.

First the obvious: if you don’t have the capital (or the appropriate sources of capital), you can’t complete the transaction.

More often, the time it takes to scrounge up capital for your deal takes away from actually guiding the deal to a peaceful closing. Getting a deal done is a stressful and time consuming project even without having to worry about sourcing capital for the deal. Add to that project dozens of processes with investors and lenders, and your deal is likely to be more sloth than gazelle.

Once more, it’s about time. Apologies to the consultants for this non-MECE list.